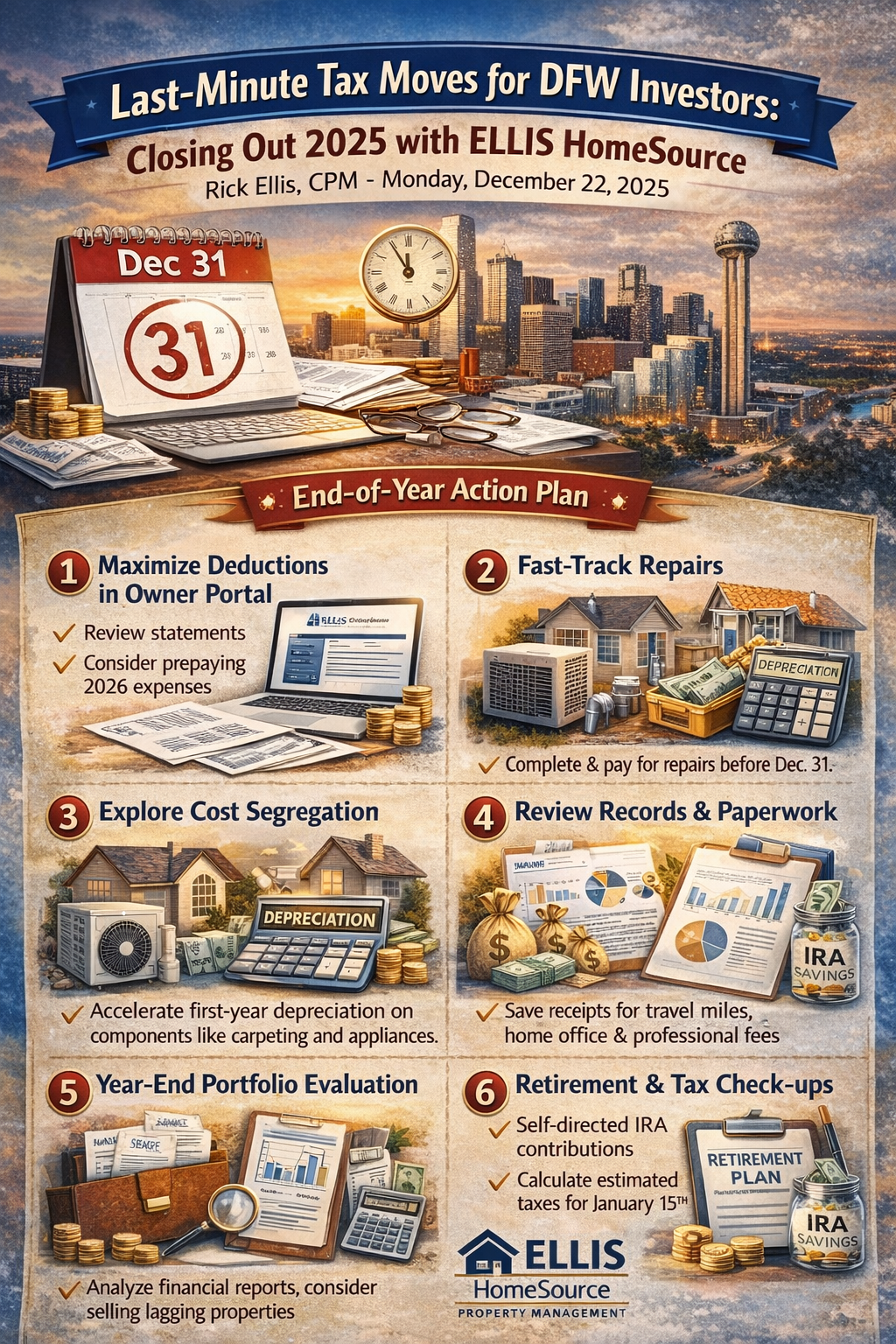

The clock is ticking on 2025. While North Texas prepares for holiday gatherings, savvy Dallas-Fort Worth investors are making strategic moves to optimize their portfolios. As an owner partnering with ELLIS HomeSource, you already have a leg up on the competition thanks to streamlined reporting and professional oversight. However, the next few weeks are critical to ensuring you keep more of your rental income and set yourself up for a successful 2026.

Here is your DFW-centric action plan for a tax-efficient year-end:

1. Maximize Your Deductions via the ELLIS Owner Portal

December 31st is your hard deadline for deductions that impact your bottom line. Since ELLIS HomeSource tracks your property's financial health, your first move should be logging into your Owner Portal.

Review Your Statements: Ensure all property-related expenses paid through ELLIS are categorized correctly.

Prepay for Early 2026: Consider prepaying your January property management fees, insurance premiums, or scheduled maintenance. If paid before midnight on December 31st, these are typically deductible in 2025, lowering your current taxable income.

2. Fast-Track Necessary Repairs

In the DFW market, winter is the ideal time to handle maintenance before the frantic spring leasing season begins.

Fix It Now: Any repairs completed and paid for by year-end—leaky faucets in Arlington, HVAC servicing in Plano, or fence repairs in Fort Worth—can be deducted this year.

Repairs vs. Improvements: Remember, fixing a broken window is a deduction (100% write-off now), while replacing all windows is an improvement (depreciated over 27.5 years). Talk to your ELLIS property manager about knocking out those "deductible" repairs before the New Year.

3. Leverage "Cost Segregation" on New DFW Acquisitions

Did you add a new property to your DFW portfolio in 2025? A Cost Segregation Study could be your biggest win. This allows you to accelerate depreciation on components like carpeting, appliances, and landscaping. Instead of waiting decades, you can take massive deductions upfront, significantly offsetting your 2025 rental income.

4. Review Your "Paper Trail"

You can’t deduct what you can’t prove. While ELLIS HomeSource provides comprehensive monthly and year-end statements, you likely have "outside" expenses to organize:

Travel Miles: Did you drive to DFW to check on your properties? Track those miles.

Home Office: Do you manage your ELLIS portfolio from a dedicated home office?

Professional Fees: Gather invoices for any legal or accounting services used this year.

5. Evaluate Your Portfolio Performance

Before the calendar flips, look at the "Big Picture" provided by your ELLIS financial reports.

Underperformers: If a property is consistently lagging, December might be the time to consider a sale or a 1031 Exchange.

Structure Check: Is your North Texas portfolio still held in your personal name, or is it time to move it into an LLC? Consult your CPA this month to see if a structural change before January 1st offers better liability protection or tax advantages.

6. Retirement & Estimated Tax Checks

Self-Directed IRAs: Many DFW investors use self-directed IRAs to buy real estate. Ensure your contributions are on track.

January 15th Deadline: Your final federal estimated tax payment is due soon. Use your ELLIS year-to-date cash flow reports to calculate this accurately and avoid underpayment penalties.

Don't Go It Alone

Tax season doesn't have to be a headache. Between the robust financial reporting from ELLIS HomeSource and a real estate-savvy CPA, you have the tools to maximize your wealth.

The next few weeks are crucial. Act now, and you’ll start 2026 with the confidence that your DFW investments are working as hard for you as possible.